In the startup world, a minimum product is often seen as the quickest way to prove an idea works. Yet, many founders walk into investor meetings confident, only to walk out without funding. The reason is simple: what you believe is a strong MVP may not be what investors want to see. That difference is where most opportunities slip away.

Why MVP fails in these moments has less to do with coding skills or design and more to do with strategy. Investors look at whether your product solves the problem, can grow with demand, and has a clear path to revenue. If your MVP does not show these points from the start, even a promising concept can get passed over.

This blog covers the main reasons MVPs fail to impress investors and the steps you can take to fix them before your next pitch.

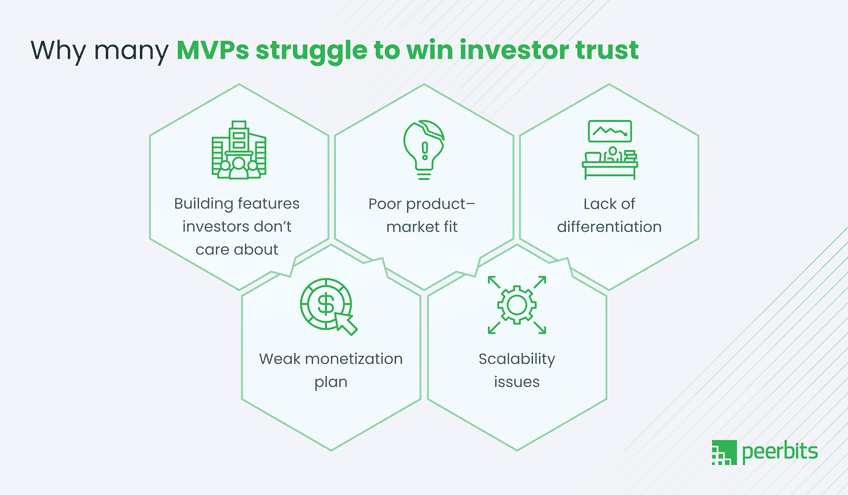

Why most MVPs fail to impress investors

Many MVPs fail not because the idea is bad, but because the product is built with the wrong priorities in mind. Startups sometimes keep adding features, thinking it will show progress, but this can pull attention away from the main problem the product is meant to solve. For investors, too many features can signal a lack of focus and make it harder to see the core value.

1. Building features investors don’t care about

Adding more features without a clear link to the main purpose can confuse the product’s positioning. Investors want to understand the problem you’re solving in seconds, anything that distracts from that reduces interest.

2. Poor product–market fit

When the problem hasn’t been validated with the right audience, even a well-built product can miss the mark. Investors spot this through early traction numbers, customer feedback, and market research. If the data doesn’t prove there’s real demand, funding becomes less likely.

3. Lack of differentiation

If your MVP looks like another version of products already in the market, it’s difficult for investors to see why it would win customers. Without a clear competitive edge, it becomes just another option rather than a standout solution.

4. Weak monetization plan

Even a functional product won’t attract funding if it lacks a tested revenue model. Investors want clarity on how the product will make money, and uncertainty here can make the opportunity look risky.

5. Scalability issues

An MVP that only works for a small market or limited user base may perform well in the short term, but if scaling requires a complete rebuild, investors see it as a costly and risky path forward.

Role of custom software in MVP success

The way your MVP is built can have as much impact on investor interest as the idea itself. While templates and off-the-shelf tools can speed up development, they often limit flexibility and make it harder to stand out in a competitive market.

1. Why template-based builds often limit investor appeal

Investors look for products that can adapt and scale. Template-based builds may work for early demos, but they usually come with technical constraints, limited customization, and dependencies on third-party platforms. These restrictions can make scaling costly and slow, which signals risk to investors.

2. How tailored development supports market fit and scalability

Software development company lets you create exactly what your target audience needs while building on a foundation that can grow. It also makes it easier to integrate unique features, proprietary technology, and competitive advantages. This flexibility helps you respond to market changes without having to rebuild from scratch.

3. Examples of MVPs improved through custom development

A marketplace startup that began with a generic template often faced performance issues once traffic increased. After moving to a custom build, they improved load times, added unique matching algorithms, and attracted seed funding.

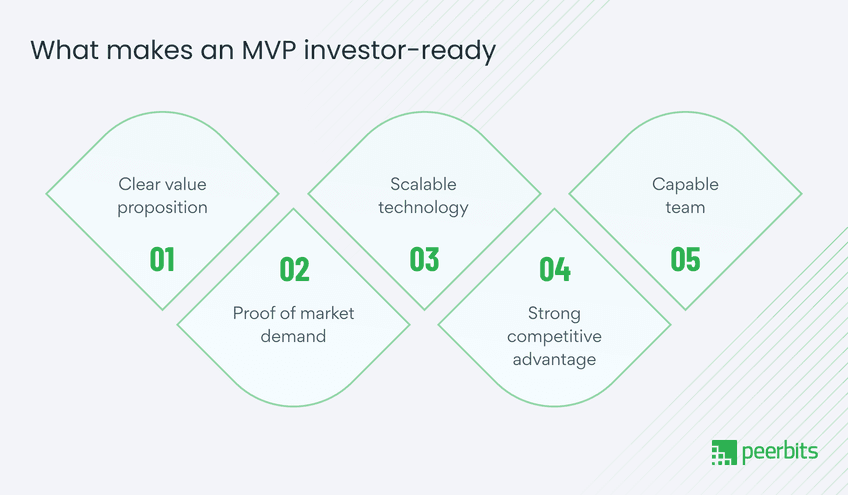

What investors actually look for in an MVP

Investors want more than just a working product. They look for signs of growth, profitability, and market potential. Partnering with an experienced MVP development company can help you build a product that highlights these factors from the start, giving you a stronger chance at securing funding.

1. Clear value proposition

The first thing investors want to understand is the exact problem your product solves. This should be explained in one straightforward line, without jargon. If the value is not clear immediately, the rest of the pitch loses impact.

2. Proof of market demand

Ideas are easy to present, but investors need evidence that people actually want the product. Metrics such as user engagement, retention rates, and pilot sales help confirm that the market is ready and willing to adopt your solution.

3. Scalable technology

Beyond solving a problem today, investors look at whether the technology can handle future growth. Choosing a stack and architecture that can support more users, new features, and larger data volumes shows foresight and reduces the risk of expensive rework later.

4. Strong competitive advantage

A product that is different for the right reasons stands out in the market. This could be intellectual property, proprietary algorithms, unique integrations, or exclusive data access. Anything that is hard for competitors to copy strengthens the case for investment.

5. Capable team

Even the best idea can fail without the right people to deliver it. Investors assess the team’s skills, experience, and track record to see if they can adapt to challenges and execute the vision effectively.

How to fix an MVP that’s falling short

If your MVP hasn’t gained investor interest, it doesn’t always mean starting over. In many cases, refining its focus, presentation, and scalability can make all the difference before the next pitch.

1. Refocus on the core problem

Strip away features or design elements that don’t directly serve your unique selling point. Investors want to quickly see what makes your product valuable. Keeping the MVP centered on the main problem helps strengthen that message.

2. Run targeted user testing

Small, focused feedback loops from the right audience can highlight exactly what works and what needs improvement. This process not only improves the product but also gives you real data to share with investors, proving market interest.

3. Plan for scalability

From the start, use technology choices that can handle a growing user base, new features, and larger workloads without major rebuilds. Investors see scalable architecture as a sign that the business can grow without costly technical setbacks.

4. Strengthen your pitch

Your MVP presentation should clearly link the problem, the solution you’ve built, and the traction you’ve achieved so far. A well-structured pitch makes it easier for investors to understand why this product has a strong future.

5. Show early traction

Even small wins like early customer sign-ups, pilot project success, or partnerships can make your pitch more convincing. These milestones give investors confidence that the product already has momentum.

Deciding between iteration and rebuild

Once you understand why your MVP fails to impress investors, the next step is deciding whether to refine what you have or start from scratch. Both paths have risks and benefits, and the wrong choice can waste time and resources.

How to know if small changes will work

Iteration is the better path when the core product works, the problem is validated, and most investor concerns are about presentation, features, or scalability. In these cases, focused adjustments can improve your pitch without slowing down your fundraising timeline.

Signs a rebuild is the better choice

If your MVP has deep issues such as targeting the wrong market, lacking a competitive edge, or using technology that cannot scale, it may be more efficient to rebuild. A restart also makes sense if fixing existing problems would cost more than developing a fresh version.

Cost and timing factors investors care about

Investors want to know how your decision affects time to market and total capital needs. A rebuild might deliver a stronger product, but if it delays launch by a year it could reduce appeal. On the other hand, if iteration ends up costing more than expected due to outdated tech, a rebuild may be the smarter option.

Conclusion

An MVP is more than a quick prototype. It’s the first impression investors use to judge whether your idea is worth backing. A half-baked build can slow down conversations, while a well-thought-out MVP shows clarity, focus, and readiness to grow.

Custom software plays a big part here. Unlike template-based builds, it adapts to your market, scales with demand, and highlights the uniqueness of your idea. This signals to investors that you’re serious about long-term growth, not just testing the waters.

Many startups that secured funding did so because their MVP stood out with strong functionality and a clear business case. That’s the difference between being seen as an experiment and being seen as an opportunity.

FAQs

Timelines vary depending on complexity, but most custom MVPs take between 3 to 6 months. The advantage is that you get a solid foundation instead of a rushed product that needs rework later.

Yes. Investors look for signs that a product can adapt to future demand. A custom MVP shows flexibility and scalability, while a template often signals short-term thinking.

It depends on features and integrations. On average, startups invest between $30,000 to $150,000 for a reliable MVP. The costs are higher than template-based builds but usually save money long term by reducing rebuilds.

You can, but it often requires replacing most of the codebase. For many startups, it ends up costing more than starting with a custom MVP in the first place.

Sectors like fintech, healthtech, logistics, and SaaS platforms gain more from custom builds because they rely heavily on scalability, compliance, and user trust.

If your product idea is niche, requires unique workflows, or has long-term scaling goals, then starting with a custom MVP makes more sense than testing with a generic template.